Overview

The Research Workshop gave participants the opportunity to present their work, receive feedback, and connect with other members of our community to foster relationships for future collaboration. The two-day event began with opening remarks by Joseph Stiglitz and featured eight sessions on the first day covering Microeconomics, Innovation and Structural Change, Climate, Sovereign Debt, Credit Markets, Networks, and Macroeconomics.

Day 1: Friday, January 24, 2025

| 9:00 – 9:30 am

(30 minutes) |

Registration and Breakfast |

| 9:30 – 9:45 am

(15 minutes) |

Opening Remarks by Joseph Stiglitz |

| 9:45 – 10:45 am

(1 hour) |

Session 1 – Microeconomics: Competition and Market Power· Federico Kochen, Center for Monetary and Financial Studies (CEMFI) — The Origins of Top Firms · Parijat Lal, Columbia University — Cooperatives, Competition, and Compensation · Felipe Lobel, Columbia University — Optimal Informality: A Mechanism Design Approach · Has van Vlokhoven, Tilburg University — The Rise in Profits and Fall in Firm Entry: A Tale of the Life Cycle of Profits |

| 10:45 – 11:05 am

(20 minutes) |

Break |

| 11:05 am –12:20 pm

(1 hour & 15 minutes) |

Session 2 – Innovation and Structural Change· Felix Corell, VU Amsterdam — Trade, Competition, and Innovation: Evidence from Europe and the US · Bilge Erten, Northeastern University — The Impact of FDI Liberalization on Structural Transformation and Demographic Change: Evidence from China · Lukas Freund, Columbia University — For Whom the Bot Tolls: A Method to Estimate the Earnings Effects of AI · Michael Poyker, UT Austin and IZA — Crime and Privatization: Effect of Privatization on Economic Development in post-Soviet Russia · Clement Bohr, UCLA Anderson School of Management — Engel’s Treadmill: A Theory of Balanced Growth and Perpetual Sectoral Turnover |

| 12:20 – 1:05 pm

(45 minutes)

|

Session 3 – Climate· Haaris Mateen, University of Houston — Climate Clubs, Participation and Efficiency: Can “Reparations” Help? (with Prajit Dutta) · Linus Mattauch, TU Berlin, Germany — Behavioural political economy: an application to climate policy in the European Union · Nils Kupzok, Columbia University, Center for Political Economy — Toward the Varieties of Climate Capitalism: Explaining the Uneven Green Fiscal Expansion |

| 1:05 – 1:20 pm

(15 minutes) |

Grab lunch for lunch session |

| 1:20 – 2:05 pm

(45 minutes) |

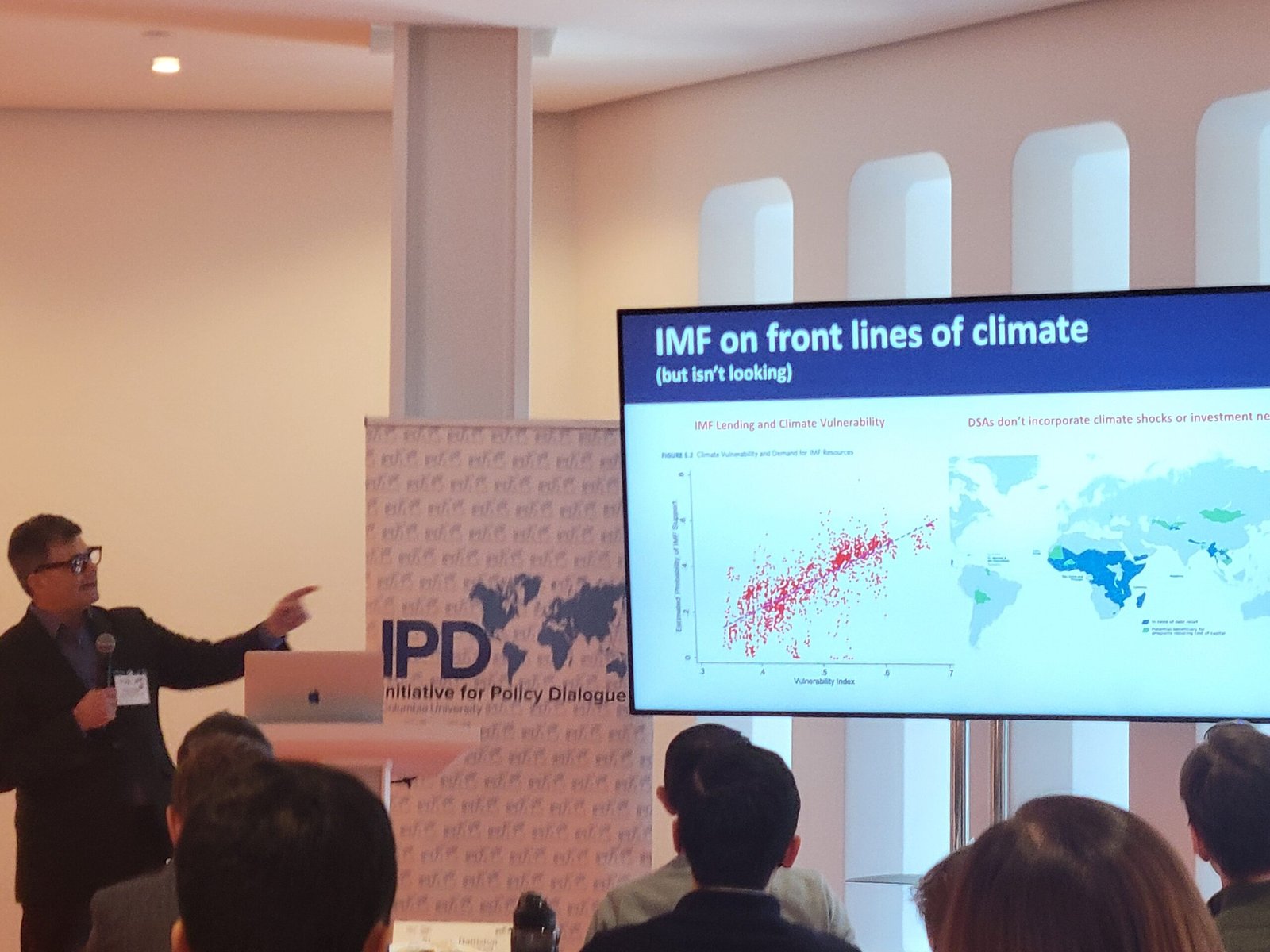

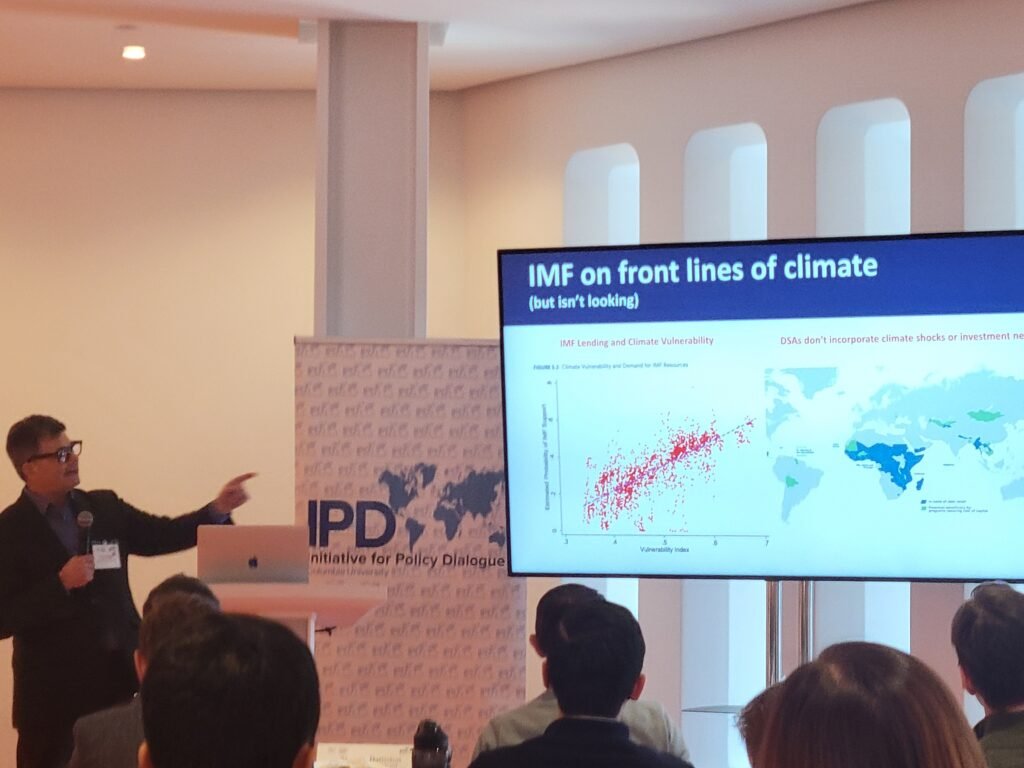

Session 4 – Lunch Talk· José Antonio Ocampo, Columbia University, Initiative for Policy Dialogue — Reforming the Global Financial and Tax Agenda · Kevin Gallagher, Boston University, Global Development Policy Center — Earth to the IMF: Climate Change, Financial Stability, and Development |

| 2:05 – 2:35 pm

(30 minutes) |

Session 5 – Sovereign Debt· Cristián Cuevas, Universidad de los Andes — The Economics of Comparability of Treatment in Sovereign Debt Restructurings · Martín Guzmán, Columbia University SIPA, Initiative for Policy Dialogue, International Financial Architecture Reform and Sovereign Debt Sustainability |

| 2:35 – 2:55 pm

(20 minutes) |

Break |

| 2:55 – 3:40 pm

(45 minutes) |

Session 6 – Credit Markets· Mayuri Chaturvedi, University of Liverpool — Banking on Jobs: Impact of a Workfare Program on Formal Credit · Dario Laudati, Columbia University, Center for Political Economy — The political economy of banks and shadow banks competition · William D. O’Connell — Columbia University, Center for Political Economy — Plans are useless, but planning is indispensable: Success and failure in the resolution of Credit Suisse |

| 3:40 – 4:25 pm

(45 minutes) |

Session 7 – Networks· Stefano Battiston, University of Zurich and Ca’ Foscari University of Venice — Unstable by Design? Taming Systemic Risk in Endogenous Financial Networks · Agostino Capponi, Columbia University — Are Supply Networks Efficiently Resilient? · Margit Reischer, Georgetown University — From Micro Connections to Macro Persistence |

| 4:25 – 4:45 pm

(20 minutes)

|

Break |

| 4:45 – 5:45 pm

(1 hour) |

Session 8 – Macroeconomics· Ignacio González, American University, Institute for Macroeconomic & Policy Analysis (IMPA) — Capacity Utilization, Markup Cyclicality, and Inflation Dynamics · Juan Herreño, University of California San Diego — The Causal Effects of Expected Depreciations · Tomohiro Hirano, Royal Holloway, University of London —Credit, Land Speculation, and Low-Interest-Rate Policy · Juan Antonio Montecino, American University, Institute for Macroeconomic & Policy Analysis (IMPA) — Market Power Wealth and the Macroeconomy |

| 6:30 pm |

Conference Dinner |

The second day featured three sessions covering Inequality with Arjun Jayadev, Clara Martínez-Toledano, Jacob Robbins, and Philipp Wangner; Labor Markets with Sadhika Bagga, Justin Bloesch, and Christopher Boone; and a final session with Michael Gould-Wartofsky, Andrew Kosenko, and Andreas Schaab.

Day 2: Saturday, January 25, 2025

| 9:00 – 9:15 am

(15 minutes) |

Registration and Breakfast |

| 9:15 –10:15 am

(1 hour) |

Session 9 – Inequality· Arjun Jayadev, Azim Premji University — Social networks and experienced inequality · Clara Martínez-Toledano, Imperial College London Business School — Private Capital Markets and Inequality · Jacob Robbins, University of Illinois at Chicago — The Distribution of Capital Gains in the United States · Philipp Wangner, University of Mannheim — Consumption, Wealth, and Income Inequality: A Tale of Tails |

| 10:15 – 11:00 am

(45 minutes) |

Session 10 – Labor Markets· Sadhika Bagga, University of Rochester — Internal and External Labor Markets and Declining Dynamism · Justin Bloesch, Cornell University — Monopsony with Recruiting · Christopher Boone, University of Massachusetts Amherst — Employer market power and its implications for HR theory and practice” |

| 11:00 – 11:15 am

(15 minutes) |

Break |

|

11:15 am – 12:00 pm (45 minutes) |

Session 11 – Final Session· Michael Gould-Wartofsky, Columbia University, Center for Political Economy — Austerity and the Rise of the Far Right: The Cases of the United States and the European Union, 2008 – 2020 · Andrew Kosenko, Marist College — Overcoming Limits of Standard Models of Information, and Models of Memory · Andreas Schaab, UC Berkeley — The Time Inconsistency of Welfare Assessments |

| 12:00 – 12:15 pm

(15 minutes) |

Closing Remarks by Joseph Stiglitz |

| 12:15 – 1:00 pm |

Lunch |